33%

Spending Jump

In Healthcare Since 2000

17.9%

Economic Driver

Healthcare accounts for large part of GDP

The Healthcare Landscape

Change can be good

Changing Markets

A growing and aging population is placing new demands on the nation’s healthcare system, while technological advances and shifting consumer preferences are increasing demand for easier access to care in lower-cost settings in communities.

Healthcare providers of all sizes are responding to these demands by using real estate to serve patients more efficiently and effectively. The manifold benefits of more diverse offerings for care are fueling an increase in off-campus locations that will help providers boost revenue and trim costs.

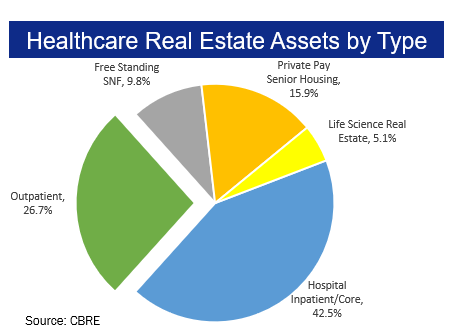

This increase in facilities, and healthcare provider’s desire to lease rather than own in order to free up capital, provides an enormous investment opportunity for experts in healthcare real estate. Additionally, the expansion of off-campus facilities has led to well-located, newly constructed buildings, which frequently make for better real estate investments than the original hospital campus assets.

More Seniors, More Care

GROWING & AGING POPULATION

Trends Heading Higher

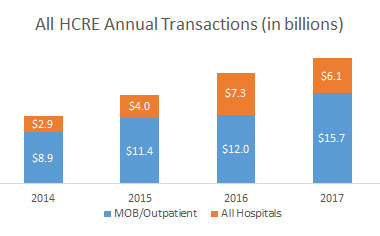

Huge Increase of Sales Transactions.

Source: Revista